61+ what percentage of your monthly income should go to mortgage

Were not including additional liabilities in estimating the. Lock Your Rate Today.

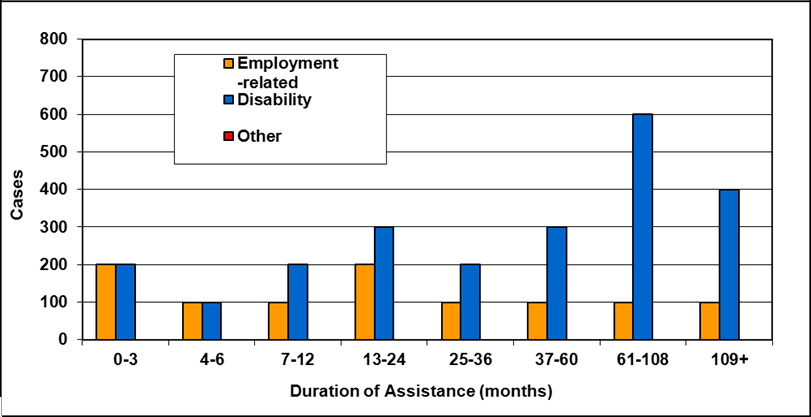

Social Assistance Statistical Report 2009 2013 Canada Ca

VA Loan Expertise and Personal Service.

. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Principal interest taxes and insurance. Web The Bottom Line.

Web The 3545 Model. Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest. Keep your mortgage payment at 28 of your gross monthly income or lower.

Web The 28 Rule. As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. This rule says you.

Ad Award Winning Client Service. Some financial experts recommend other percentage models like the 3545 model. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

The 28 rule isnt universal. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Web A 15-year term.

Web However lenders are usually more conservative than the federal limit typically sticking around 28 percent of your salary. Get Instantly Matched With Your Ideal Mortgage Lender. So a 4000 salary will usually.

Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Get Your Quote Today. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes.

Contact a Loan Specialist. Compare More Than Just Rates. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Find A Lender That Offers Great Service. Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance.

Web The 3545 model. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax.

Web Front-end only includes your housing payment. Thats a mortgage between 120000 and. Ad 10 Best Home Loan Lenders Compared Reviewed.

When determining what percentage. Compare Rates Get Your Quote Online. Comparisons Trusted by 55000000.

Web But there are two other models that can be used. Web A fairly established and well-known piece of wisdom the 28 rule also known as the 2836 rule advocates that homeowners should spend 28 of their gross. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Keep your total monthly debts including your mortgage.

How Much Of My Income Should Go Towards A Mortgage Payment

Pdf The Contribution Of Universal Health Insurance Coverage Scheme To Villagers Wellbeing In Northeast Thaila Farung Meeudon Academia Edu

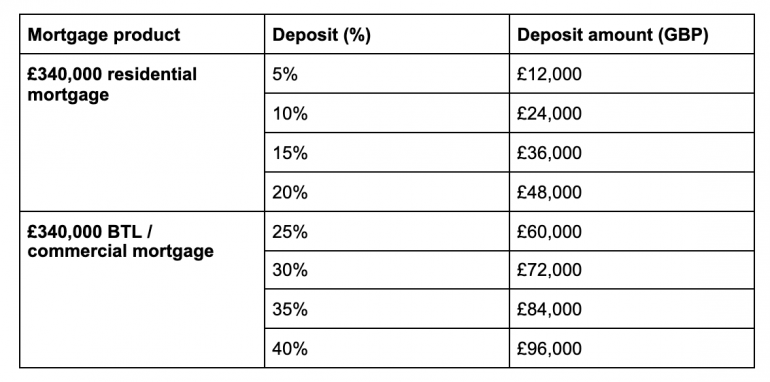

340 000 Mortgages Affordability Eligibility Requirements

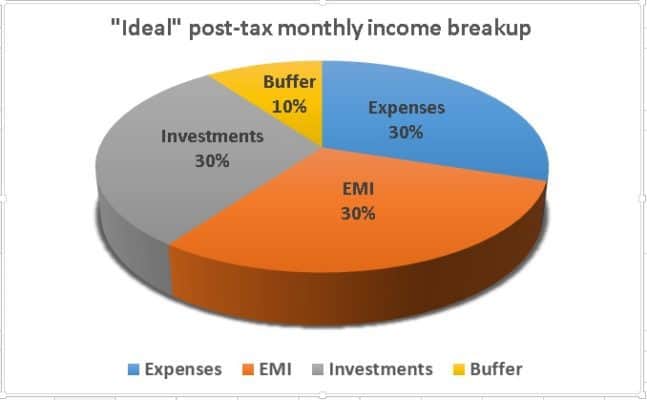

What Percentage Of Monthly Income Should My Home Loan Emi Be

Here S How To Figure Out How Much Home You Can Afford

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Income Should Go To A Mortgage Bankrate

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

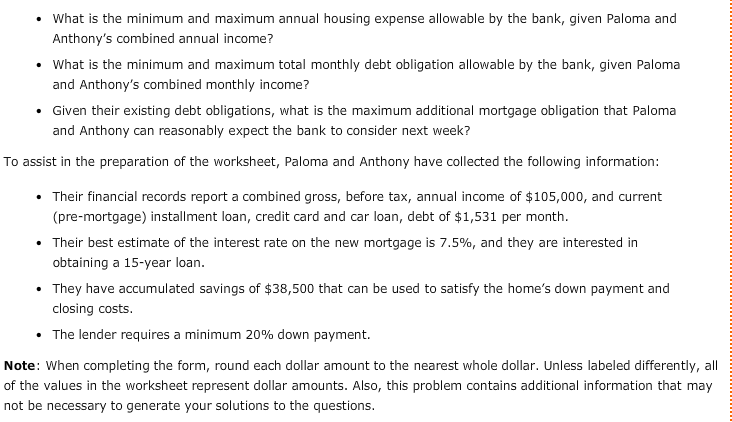

Solved First Filling The Blank A Back End B Front End Chegg Com

The Percentage Of Income Rule For Mortgages Rocket Money

What Percentage Of Income Should Go To Mortgage Morty

How To Find Out If You Can Afford Your Dream Home

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Income To Mortgage Ratio What Should Yours Be Moneyunder30

How Much House Can I Afford Moneyunder30